I’m going to talk about something in this blog which might make people feel uncomfortable. Because it’s another one of those topics that can be fairly taboo. We don’t really talk about it. And it’s not a three-letter word which would definitely make my daughter feel uncomfortable, but a five-letter one.

Money

As well as the grief and all the emotional aspects of being widowed young, there is also an incredibly practical impact too. The financial impact. And the perception that people have around this. I’m pretty sure that there are people out there who think that I’m the merry widow living the life of Riley and mortgage free because my husband died. This isn’t just me speculating, I vividly remember bumping into someone who knew my late husband about a year after he died to be met with the comment “you must be laughing now you don’t have a mortgage anymore.” There is so much wrong with this sentence, I don’t really know where to start. I also had a friend say “well, you have been spending a lot of money lately” in 2022, two years after my husband died. To be fair to them, they were right, we had. My daughter had danced in Disneyland Paris with her dance school, we’d been on holiday to Florida and I’d been doing some house renovations. But I’d only had been able to do this because my husband died. Would I rather have not been spending the money, not going on holiday and not renovating the house but have my husband alive? Yes. That’s an unequivocal yes.

Because in short, while I might spend money, I’m not laughing. Because I do still have a mortgage. The Florida holiday and house renovations were paid for out of the life insurance, I didn’t use it fully on my mortgage. The irony of my late husband’s life insurance does still cause me have a wry smile. We’d changed and updated our life insurance policies about nine months before he died, but, because of his previous cancer diagnosis and the fact his cholesterol wasn’t great, the monthly premiums were high. We didn’t take out a policy for him which would have meant that the mortgage would be paid off entirely in the event of his death, opting instead for just a big chunk. Had we both known we’d only be paying it for nine months I think we’d have swallowed that monthly cost. But that’s the thing with insurance, isn’t it? You don’t ever really expect to be making a claim, do you? I’m just so incredibly grateful that we did at least have something in place; because in the immediate aftermath of his death, it meant that my daughter and I were able to stay in our home and not have to deal with selling and moving on top of everything else we had to navigate.

I’ll openly admit I entered quite a lengthy “life is too short” era when the world opened up again following lockdown. My daughter and I had a “F**k It Week” in 2022 where we saw multiple shows across a week and went away. I’ve been reluctant to say no to things for fear of us missing out. I’ve tried to make as memories as possible as I can for my daughter because ultimately memories are all we have left. Have I made the best financial choices since my husband died? Probably not, no. It’s something that I’m dealing with. But can I look back and smile at the adventures we’ve had? Yes. And that’s what’s most important to me.

Yet nearly six years on, our lives are about to change and enter a new phase. On top of the increases in the cost of living. Money is something that is incredibly prevalent to me right now. For the first time since my late husband died, I’m feeling an enormous sense of responsibility to make the right decision for us. So many decisions were taken out of my hands in the early days that I didn’t really feel the pressure. But now I am. Should I find a new job? Should I sell my house? Should I take out extra on my mortgage? What can I do on my own to help fund the additional costs that I need to find from September this year? It’s actually quite mentally exhausting. Although, sorting and selling on Vinted and eBay is quite therapeutic (running joke that I can’t leave my house without a parcel to send) and I am getting a little bit of enjoyment from finding all the yellow and orange stickers in supermarkets when they sell off their food at the end of the day to help save costs. I think eight large sausage rolls for 25p has got to be my best find to date!

But putting levity aside for a second. My situation is not unique. There are thousands of young widows across the UK who suddenly find themselves without the salary of their partner or struggling financially. There are so many different situations. The families who didn’t have life insurance for a myriad of reasons. The families with ill health preventing them from working. The families where the parent has continued working but grief has been incredibly difficult for them so they don’t perform as they once did and so don’t get a pay rise or bonus. The families who are forced to sell their homes because they can’t afford to stay there. The families who desperately need to join WAY Widowed and Young, but can’t afford the £30 membership for the year so need to make an application to the Memorial Fund which was set up in 2017 to assist members to join the charity.

Like I say. Money. It’s an uncomfortable topic, isn’t it?

For those who haven’t been in my situation, you might also be thinking “but surely there is some benefit or support for widows.” And to be fair to you if you are thinking this, you’re right. But it only lasts for 18 months. The financial support I received for my daughter ran out towards the end of 2021 when she was 11-years-old. Assuming she stays in full time education until she’s 18 and then goes on to do a degree, that financial support will have run out 10 years before the end of her degree course. This will be funded out of student loans, my salary and my salary alone.

Let me tell you a little about the support that is available. It’s called Bereavement Support Payment (BSP). It was introduced in 2017 and replaced Widowed Parent’s Allowance, which provided weekly payments until Child Benefit ceased. BSP has not been updated since 2017 and indicative figures suggest that it is now worth £3,726.49 less in real terms for bereaved families with children. And even more staggering is that until February 2023, the Widowed Parent’s Allowance and BSP were only available to people who were married or in a civil partnership when their loved one died. It was only following a decade-long campaign by WAY Widowed and Young, the Childhood Bereavement Network, the Child Poverty Action Group and a coalition of other bereavement charities, that the government finally changed the legislation in 2023 so that cohabiting parents were entitled to the same support. Imagine that for just a second. You’ve been with your partner for a number of years, you have children together, you’ve built a life together but because you weren’t married or in a civil partnership, you were deemed ineligible for financial support from the government. I still find it absolutely staggering and am so grateful to everyone who campaigned for this change.

But back to what BSP does provide. The most you can get (depending on circumstance) and what I received, was a one-off payment of £3,500 followed by 18 monthly payments of £350. And while BSP has been extended to cohabiting couples with children, unmarried couples without children are still being denied support. People are still being penalised for their life choices in 2026. People are still suffering financially due to the death of a partner. Something needs to be done.

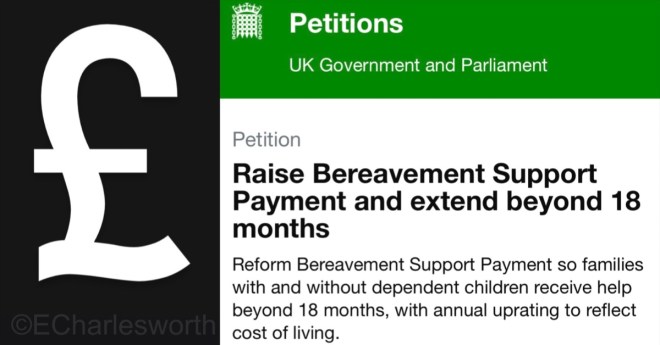

And that’s why I’m so supportive of Caroline Booth and Widows Fight. Caroline is spearheading a national campaign to reform BSP, which she says is “morally indefensible” in its current form and failing thousands of grieving families. She launched a petition a few weeks ago which has already received over 15,000 signatures. The government does now have to respond to this petition because it has to respond to all petitions that get more than 10,000 signatures. This is a great achievement so far. I only hope that it continues to gain momentum and leads to a real change for anyone who goes through what I have.

You can sign the petition here and follow Widows Fight on Instagram and Facebook.

You can find out more information on the campaigns that WAY Widowed and Young is involved with on the website.